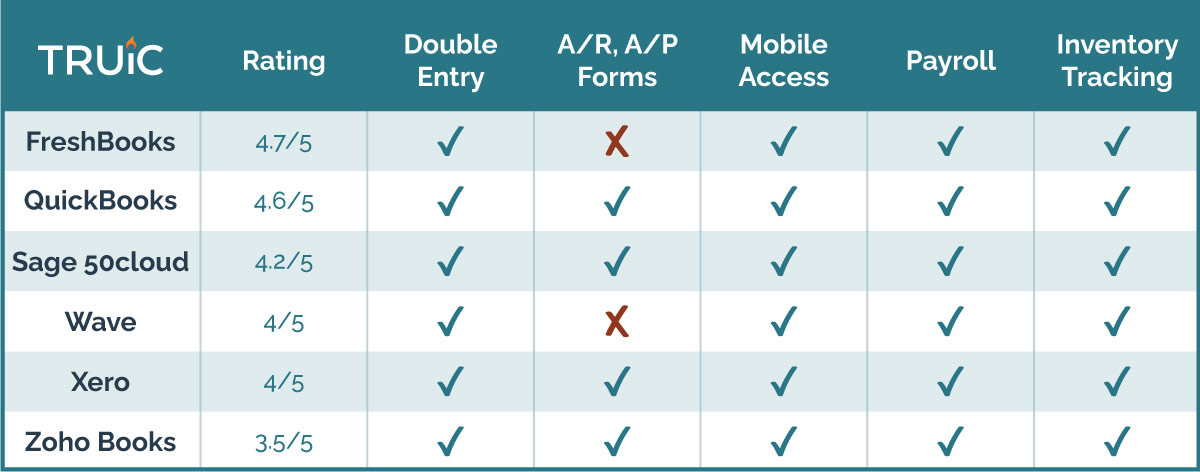

Small businesses need efficient accounting software. The right tools can save time and reduce errors.

In today’s digital age, managing finances can seem daunting. That’s where accounting software comes in. It’s designed to simplify bookkeeping, invoicing, payroll, and more. For small business owners, finding the best software is crucial. It can make daily operations smoother and less stressful.

With so many options available, choosing the right one can be overwhelming. This blog will guide you through the best software options. You’ll learn about features, benefits, and how they can help your business thrive. Let’s dive in and discover the ideal accounting tools for your needs.

Quickbooks Online

QuickBooks Online is a popular choice for small business accounting. It offers various tools to manage finances efficiently. Its user-friendly interface makes it accessible to all skill levels.

Key Features

QuickBooks Online includes features like invoicing, expense tracking, and reporting. It integrates with many apps to streamline workflows. Users can access their accounts from any device with internet access.

Automated features save time on repetitive tasks. Customizable reports offer insights into business performance. Bank reconciliation keeps financial data accurate and up to date.

Pros And Cons

QuickBooks Online has many advantages. It is easy to set up and use. Cloud access ensures data is available anywhere. Regular updates add new features and improve security.

But there are some drawbacks. Subscription costs can be high for small businesses. Some users find customer support response slow. Advanced features may require additional fees.

Despite these cons, QuickBooks Online remains a solid choice. Its balance of features and ease of use makes it ideal for many small businesses.

Credit: www.pcmag.com

Xero

When managing finances for your small business, choosing the right accounting software is crucial. Xero is a popular option among entrepreneurs due to its user-friendly interface and robust features. Let’s delve into why Xero stands out and how it can benefit your business.

Key Features

Xero offers a comprehensive set of features designed to simplify accounting for small businesses. One of the standout features is its cloud-based nature, which allows you to access your financial data from anywhere. This flexibility is a game-changer for business owners constantly on the move.

Moreover, Xero integrates seamlessly with various third-party apps. This means you can easily connect your accounting software with tools like payroll systems, CRM software, and inventory management apps. This integration capability helps streamline your operations.

Another key feature of Xero is its invoicing system. You can create professional invoices quickly and send them directly to clients. The software also tracks these invoices and sends reminders for overdue payments, ensuring you never miss out on your hard-earned money.

Pros And Cons

Like any software, Xero has its strengths and weaknesses. Understanding these will help you decide if it’s the right fit for your business.

Pros:

- User-friendly interface: Xero is designed with simplicity in mind, making it easy for anyone to use, even without an accounting background.

- Cloud-based access: You can manage your finances from any device with internet access, giving you flexibility and control.

- Integration with third-party apps: Xero connects with various tools, enhancing its functionality and saving you time.

- Automated invoicing: Create and send invoices effortlessly, with automated payment reminders to ensure timely collections.

Cons:

- Cost: Xero can be more expensive than other accounting software options, especially for businesses with tight budgets.

- Limited customer support: Some users have reported difficulties in getting timely assistance from Xero’s support team.

- Complex features: While it has many powerful features, some can be overwhelming for those unfamiliar with accounting principles.

Overall, Xero is a powerful tool that can transform how you manage your business finances. Have you tried using Xero for your accounting needs? What was your experience? Share your thoughts in the comments below!

Freshbooks

If you are searching for a reliable software for small business accounting, FreshBooks could be a great choice. It is designed for small businesses and freelancers. The platform offers many features to help you manage your finances efficiently.

Key Features

FreshBooks offers several key features that make accounting easier. It has a user-friendly interface. You can create and send invoices quickly. It tracks time and expenses. You can generate detailed reports. FreshBooks allows online payments, making it easy for clients to pay you. It also integrates with other business tools like PayPal and Stripe.

Pros And Cons

FreshBooks has many pros. It is easy to use, even for beginners. The customer support is excellent. You get a clear view of your financial status. The mobile app is handy for on-the-go accounting. It also offers a free trial period.

There are some cons. The software can be pricey for very small businesses. It has limited inventory management features. Some users find the customization options lacking. Despite these cons, many small businesses find FreshBooks valuable.

Wave

Managing your small business finances can be daunting, but Wave makes it easier. Wave is a free accounting software designed specifically for small businesses. It offers a range of features that can help you keep track of your finances without breaking the bank.

Key Features

Wave is packed with features that make accounting simple and efficient. Here are some highlights:

- Invoicing: Create and send professional invoices in seconds. Customize your invoices with your logo and colors.

- Expense Tracking: Easily track your business expenses by uploading receipts and connecting your bank account.

- Financial Reports: Generate detailed financial reports to help you understand your business’s financial health.

- Bank Reconciliation: Automatically match your bank transactions with your accounting records.

- Multi-Currency Support: Handle transactions in multiple currencies, which is great if you do international business.

Pros And Cons

Like any software, Wave has its strengths and weaknesses. Here’s a quick rundown:

| Pros | Cons |

|---|---|

|

|

If you’re looking for a cost-effective way to manage your small business accounting, Wave is worth considering. It might not have all the bells and whistles of more expensive software, but it covers the basics well.

What are your thoughts on using free software like Wave for your business? Have you tried it before, or are you considering giving it a shot? Share your experiences in the comments below!

Zoho Books

When it comes to managing finances, small businesses need reliable accounting software. Zoho Books is one such tool that has gained popularity among business owners. It offers a comprehensive solution for all your accounting needs, making it easier to handle your finances efficiently.

Key Features

Zoho Books comes packed with features designed to simplify your accounting tasks.

- Invoicing: Create professional invoices, customize them to your brand, and track payments easily.

- Expense Tracking: Manage and categorize your expenses. Attach receipts for better record-keeping.

- Bank Reconciliation: Link your bank accounts and reconcile your transactions effortlessly.

- Inventory Management: Keep track of your stock levels, manage orders, and avoid stockouts.

- Automation: Automate recurring invoices and payment reminders to save time.

- Tax Compliance: Generate tax reports and stay compliant with local tax laws.

Pros And Cons

Like any software, Zoho Books has its strengths and weaknesses.

| Pros | Cons |

|---|---|

| User-friendly interface that’s easy to navigate. | Limited integration with third-party apps compared to competitors. |

| Affordable pricing plans suitable for small businesses. | Some advanced features may require additional learning. |

| Excellent customer support with quick response times. | Mobile app functionality can be improved. |

Choosing the right accounting software is crucial for your business. Zoho Books offers a variety of features that can streamline your financial processes. If you’re looking for a balance between affordability and functionality, Zoho Books is worth considering.

Have you tried Zoho Books for your business? What features do you find most useful? Share your thoughts in the comments below!

Sage Business Cloud Accounting

Sage Business Cloud Accounting is a top choice for small businesses. It offers a range of features designed to simplify financial management. This software is cloud-based, allowing users to access their accounts from anywhere. It is user-friendly, making it suitable for those with little accounting experience.

Key Features

Sage Business Cloud Accounting has several key features. It includes invoicing, expense tracking, and financial reporting. Users can easily manage cash flow and stay on top of their finances. The software also supports integration with other business tools. This ensures seamless operation across different platforms.

Pros And Cons

Like any software, Sage Business Cloud Accounting has its pros and cons.

Pros:

- Easy to use, even for beginners.

- Accessible from any location due to its cloud-based nature.

- Provides comprehensive financial reports.

- Integrates with other business tools.

Cons:

- May be expensive for very small businesses.

- Some advanced features require higher subscription plans.

- Customer support response time can be slow.

Kashoo

When it comes to finding the best software for small business accounting, Kashoo is a name that often comes up. This cloud-based accounting solution offers simplicity and efficiency, making it an excellent choice for small business owners. Let’s delve into the key features, pros, and cons of Kashoo to see if it fits your business needs.

Key Features

Kashoo provides a range of features designed to streamline your accounting tasks. It offers:

- Automatic Bank Feeds: Connect your bank account to automatically download transactions.

- Real-Time Reporting: Get up-to-date financial reports anytime.

- Multi-User Access: Allow your team to collaborate on accounting tasks.

- Invoicing: Create and send professional invoices easily.

- Expense Tracking: Keep track of all your expenses efficiently.

- Mobile Access: Manage your accounting on the go with the Kashoo mobile app.

Pros And Cons

Understanding the strengths and weaknesses of Kashoo can help you decide if it’s the right tool for you.

| Pros | Cons |

|---|---|

|

|

As a small business owner, you need accounting software that’s both affordable and easy to use. Kashoo fits the bill perfectly. I remember when I first started my small consulting business, the thought of managing invoices and expenses was overwhelming. Kashoo’s user-friendly interface made the process seamless and stress-free.

What do you think is the most challenging part of accounting for your small business? Could Kashoo’s features simplify that task for you? Give it a try and see how it transforms your accounting process.

Credit: howtostartanllc.com

Accountedge Pro

AccountEdge Pro offers robust features for small business accounting. Manage payroll, track expenses, and generate reports effortlessly. Ideal for streamlining financial tasks.

As a small business owner, managing your finances can be challenging. That’s where AccountEdge Pro comes in. This software is designed to make accounting easier for small businesses. It’s packed with features that can help you keep track of your finances without the need for a degree in accounting.Key Features

AccountEdge Pro offers a variety of features that are particularly useful for small businesses. Firstly, it supports both Mac and Windows, making it versatile for different users. Secondly, it includes payroll processing, which can save you the cost and hassle of using a separate service. Additionally, AccountEdge Pro provides detailed financial reports, helping you make informed business decisions. It also offers inventory management, which is crucial if you sell products. You can track stock levels, set reorder points, and manage suppliers—all within the same platform.Pros And Cons

Like any software, AccountEdge Pro has its strengths and weaknesses. Pros: – User-friendly interface that is easy to navigate. – Comprehensive payroll processing included. – Multi-currency support, useful for international transactions. – Strong reporting features to help you understand your financial health. – Excellent customer support, available through various channels. Cons: – No cloud-based option, which may limit access for remote teams. – Initial setup can be time-consuming. – Lacks some advanced features found in competitor software. – Can be expensive for very small businesses on a tight budget. When I first started using AccountEdge Pro, I was amazed at how much time it saved me. The payroll feature alone saved me hours each month. Have you ever struggled with managing your inventory or payroll? If so, this software might be the answer you’ve been looking for. It’s important to weigh the pros and cons to see if it fits your business needs. What features are most important to you in accounting software?Oneup

OneUp is a robust and efficient accounting software that is perfect for small businesses. Its user-friendly interface and comprehensive features make managing finances a breeze. Whether you’re a solo entrepreneur or managing a small team, OneUp can streamline your accounting processes.

Key Features

OneUp offers a variety of features designed to make accounting easy and efficient:

- Automated Bookkeeping: Easily sync your bank transactions and let OneUp categorize them for you.

- Invoicing: Create and send professional invoices to your clients directly through the software.

- Inventory Management: Keep track of your inventory levels, orders, and deliveries all in one place.

- CRM Integration: Manage your customer relationships and track sales opportunities seamlessly.

- Reporting: Generate detailed financial reports to get insights into your business performance.

Pros And Cons

Like any software, OneUp has its strengths and weaknesses. Let’s take a look:

| Pros | Cons |

|---|---|

|

|

Have you ever struggled with managing your business accounts? OneUp might be the solution you’ve been looking for. Its automated features save time, allowing you to focus on growing your business.

However, it’s important to note the limitations, such as the lack of customization and occasional slow customer support. But if you’re looking for an affordable and user-friendly accounting software, OneUp is definitely worth considering.

Sunrise By Lendio

Sunrise by Lendio offers the best software for small business accounting. It simplifies invoicing, expense tracking, and financial reporting. Perfect for entrepreneurs seeking easy-to-use tools.

If you’re a small business owner looking for an accounting tool that won’t break the bank, Sunrise by Lendio might be the solution for you. Sunrise offers a user-friendly platform specifically designed to make accounting tasks simpler and more manageable. Whether you’re just starting out or looking to streamline your financial processes, Sunrise provides a range of features that can help you stay on top of your business finances.Key Features

Sunrise comes equipped with a variety of features aimed at simplifying your accounting needs. It includes automatic transaction categorization, which saves you the headache of manually sorting through every expense. Another standout feature is the customizable invoice templates. These allow you to maintain a professional image while making invoicing quicker and easier. You can also connect your bank accounts directly to Sunrise, making it effortless to keep track of your cash flow and monitor expenses in real-time.Pros And Cons

Pros: – Free to Use: One of the biggest advantages is that Sunrise offers a free version, making it accessible for small businesses operating on tight budgets. – User-Friendly Interface: The platform is intuitive, which means you don’t need an accounting degree to navigate it. – Customizable Invoices: Create professional-looking invoices that reflect your brand. Cons: – Limited Integrations: Sunrise currently doesn’t integrate with many third-party apps, which might be a drawback if you rely on multiple tools for your business operations. – Support: While the user interface is simple, customer support can sometimes be slow, which might be frustrating if you run into issues. – Advanced Features: Some advanced accounting features are only available in the paid versions, which can be limiting for more complex needs. Have you ever struggled with keeping your business finances in order? Sunrise by Lendio could be the game-changer you need. Its ease of use and essential features make it a strong contender for any small business owner looking to simplify their accounting tasks.

Credit: online.jwu.edu

Frequently Asked Questions

What’s The Easiest Accounting Software To Use?

QuickBooks is the easiest accounting software to use. Its user-friendly interface helps manage finances efficiently. Ideal for small businesses and freelancers.

How Much Do Quickbooks Cost For A Small Business?

QuickBooks pricing for small businesses ranges from $25 to $180 per month, depending on the plan selected.

Is Quicken Or Quickbooks Better For Small Business?

QuickBooks is better for small businesses needing advanced features. Quicken is ideal for simpler financial management. Choose based on your business needs.

Which Is The Best Accounting Software For Small Business For Free?

The best free accounting software for small businesses is Wave. It offers invoicing, expense tracking, and reporting features.

Conclusion

Choosing the right accounting software boosts your small business efficiency. Look for features that match your needs and budget. Ease of use and good customer support are crucial. Consider scalability as your business grows. The right software saves time and reduces errors.

Explore various options, read reviews, and test demos. Remember, the best software fits your business style. Prioritize your needs and make an informed decision. Your business deserves the best tools for success.