Small business owners need efficient accounting tools. FreshBooks promises simplicity and power.

Is it worth your investment? Running a small business means juggling many tasks. One critical task is managing finances. FreshBooks is a popular choice for accounting software. It offers features like invoicing, expense tracking, and time management. But does it truly meet the needs of small businesses?

In this review, we’ll dive into FreshBooks’ key features, ease of use, pricing, and customer support. Our goal is to help you decide if FreshBooks is the right fit for your business. Keep reading to explore whether this tool can simplify your accounting and save you time.

Introduction To Freshbooks

If you’re a small business owner, managing finances can be a daunting task. FreshBooks promises to simplify this process with its user-friendly interface and robust features. But is FreshBooks really worth it for small businesses? Let’s delve into what FreshBooks is all about and its brief history.

What Is Freshbooks?

FreshBooks is a cloud-based accounting software designed to help small businesses manage their finances. It offers features like invoicing, expense tracking, time tracking, and reporting.

Imagine being able to send professional-looking invoices, track your expenses, and manage your projects all in one place. FreshBooks makes it possible.

Plus, it integrates with other tools you might already be using, such as PayPal, Stripe, and G Suite. This can streamline your workflow and save you valuable time.

Brief History

FreshBooks was founded in 2003 by Mike McDerment after he accidentally saved over an invoice. He realized small business owners needed a better way to manage their finances.

Since then, FreshBooks has grown significantly. It now serves over 24 million users worldwide. This growth is a testament to its effectiveness and reliability.

Today, FreshBooks continues to innovate, adding new features and improving its interface to better serve its users. Have you tried FreshBooks yet, and if so, how has it impacted your business?

Credit: signeasy.com

Key Features

FreshBooks offers easy invoicing, expense tracking, and time management. Its user-friendly interface suits small businesses well. The software simplifies accounting tasks efficiently.

When it comes to managing a small business, finding the right tools to streamline your operations is crucial. FreshBooks is a popular choice among small business owners for its user-friendly interface and robust features. Let’s dive into some of the key features that make FreshBooks stand out. ###Invoicing

Creating and sending invoices is a breeze with FreshBooks. You can customize your invoices with your logo and brand colors. This not only makes your invoices look professional but also helps in creating a lasting impression on your clients. You can set up recurring invoices for clients you bill regularly. This saves you time and ensures that you never miss a payment. Plus, you can add a “Pay Now” button for quicker payments. ###Expense Tracking

Keeping track of your expenses is crucial for maintaining your budget. FreshBooks makes this easy by allowing you to snap photos of your receipts and upload them directly into the system. You can categorize your expenses to see where your money is going. This helps you make informed decisions and optimize your spending. ###Time Tracking

For those who bill by the hour, FreshBooks’ time tracking feature is a game-changer. You can log your hours directly into the system, making it easy to track your billable time. This feature integrates seamlessly with invoicing, so you can quickly convert your logged hours into an invoice. This ensures that you get paid for every minute of work you do. ###Reporting

FreshBooks offers a range of reports to help you understand your business better. From profit and loss statements to expense reports, you can generate detailed insights with just a few clicks. These reports are not just numbers on a page. They are actionable insights that help you make better business decisions. You can see which clients are the most profitable or which services are in high demand. FreshBooks’ key features are designed to save you time and make your life easier. Have you tried any of these features yet? What do you think?User Interface

FreshBooks offers an intuitive user interface tailored for small businesses. Its clean layout simplifies invoicing and tracking expenses. Ideal for those seeking an efficient accounting tool.

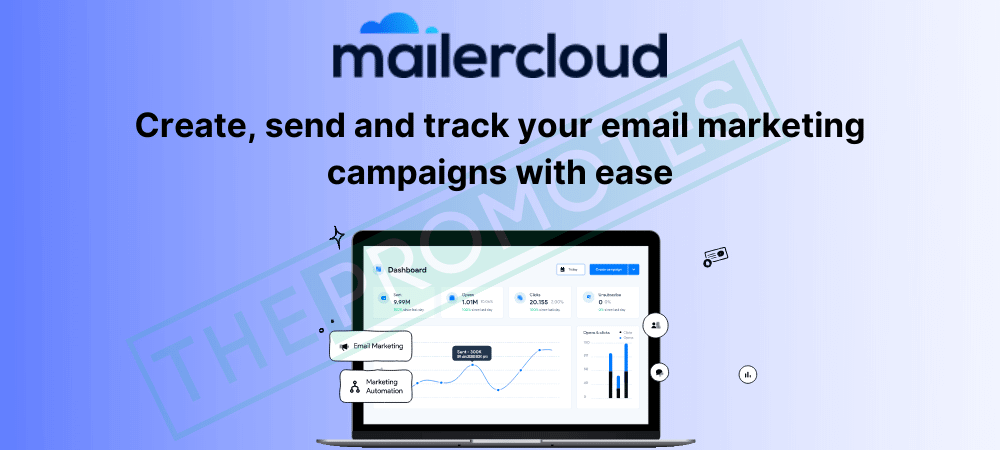

When choosing accounting software for your small business, the user interface can make or break your experience. FreshBooks is renowned for its user-friendly design, which is a crucial factor for many small business owners. Let’s dive into what makes the FreshBooks user interface stand out, focusing on ease of use and the dashboard overview.Ease Of Use

FreshBooks prides itself on simplicity. Setting up your account is a breeze. You can start invoicing clients and tracking expenses in minutes. The navigation is intuitive. Menus and buttons are clearly labeled, making it easy to find what you need without digging through multiple screens. This saves you valuable time. I remember when I first used FreshBooks, I was impressed by how quickly I got the hang of it. Even with no accounting background, I felt confident managing my finances.Dashboard Overview

The dashboard is the first thing you see when you log in. It gives you a snapshot of your financial health. Key metrics like outstanding invoices, recent expenses, and profit and loss are displayed prominently. This lets you keep tabs on your business at a glance. You can also customize the dashboard to focus on what matters most to you. Whether it’s tracking overdue invoices or monitoring cash flow, FreshBooks lets you tailor the view to your needs. Do you ever find yourself overwhelmed by complex software? FreshBooks is designed to eliminate that stress. The clean, straightforward layout helps you stay focused and organized. Have you tried navigating through FreshBooks’ dashboard? How does it compare to other tools you’ve used?Pricing Plans

Choosing the right accounting software for your small business is crucial. FreshBooks offers various pricing plans to cater to different needs. Understanding these plans can help you decide if FreshBooks is worth your investment.

Basic Plan

The Basic Plan costs $15 per month. It is perfect for freelancers or solo entrepreneurs. This plan allows up to five billable clients. You can track expenses, send invoices, and accept payments. It also includes time tracking and basic reports.

Plus Plan

The Plus Plan costs $25 per month. It is designed for growing businesses. You can bill up to 50 clients with this plan. It offers double the features of the Basic Plan. You get automated recurring invoices and client retainers. It also includes insightful reports and additional integrations.

Premium Plan

The Premium Plan costs $50 per month. It is ideal for established businesses with many clients. You can bill up to 500 clients. This plan includes all Plus Plan features. It offers advanced payments and team timesheets. You also get priority customer support.

Custom Pricing

The Custom Pricing plan is for large businesses with unique needs. You need to contact FreshBooks for a quote. This plan offers personalized features. It includes a dedicated account manager. You get advanced reporting and data migration assistance. It is the most flexible option.

Customer Support

Customer support can make or break a software experience. Good support ensures you can resolve issues quickly. FreshBooks offers various customer support options. Let’s dive into them.

Support Channels

FreshBooks provides several support channels. You can reach them via phone. Email support is also available. They even offer live chat on their website. These options make it easy to get help.

Response Time

Response time is crucial for small businesses. FreshBooks promises quick responses. Their phone support is immediate. Emails get answered within a few hours. Live chat is almost instant. This speed helps resolve issues fast.

Credit: www.nav.com

Pros And Cons

FreshBooks offers easy invoicing and expense tracking, ideal for small businesses. Some users find the pricing a bit high. Overall, it provides solid accounting features.

When considering Freshbooks for your small business, weighing the pros and cons is crucial. Understanding the benefits and drawbacks will help you decide if it’s the right fit for your needs. Here, we’ll break down the advantages and disadvantages to provide a clear picture.Advantages

Freshbooks has a user-friendly interface. It’s easy to navigate, even if you’re not tech-savvy. You can quickly create and send invoices, track expenses, and manage projects. The customer service is excellent. They offer prompt support via phone and email. This can be a lifesaver when you need help quickly. Automated features save time. For instance, recurring invoices and automatic payment reminders reduce manual work. This allows you to focus more on growing your business. Integration with other tools is seamless. Freshbooks connects with apps like PayPal, Stripe, and G Suite. This helps streamline your workflow without switching between platforms.Disadvantages

The cost can be a downside. Freshbooks charges a monthly fee, which can add up over time. For very small businesses or startups, this might be a concern. Limited customization options may be frustrating. You might find the templates and reports too basic. If you need highly specific reports, Freshbooks might fall short. The mobile app lacks some features. While convenient for on-the-go, it’s not as robust as the desktop version. You may need to wait until you’re back at your computer to complete certain tasks. Freshbooks is primarily designed for service-based businesses. If your business involves a lot of inventory management, it may not be the best option. You could find the features too limited for your needs. Is Freshbooks the right choice for your small business? Consider these pros and cons carefully. Your decision could significantly impact your daily operations and long-term success.Comparisons With Competitors

Choosing the right accounting software for your small business is crucial. FreshBooks is a popular option, but how does it compare to its competitors? Let’s explore FreshBooks against QuickBooks, Xero, and Wave.

Quickbooks

QuickBooks is a well-known name in accounting software. It offers a wide range of features. FreshBooks, in comparison, is more user-friendly. QuickBooks has a steeper learning curve. It is better suited for larger businesses. FreshBooks is ideal for small businesses and freelancers. QuickBooks has more advanced reporting tools. FreshBooks focuses on ease of use and simplicity.

Xero

Xero is another strong competitor. It provides robust features for small businesses. FreshBooks stands out with its intuitive design. Xero offers unlimited users in its plans. FreshBooks charges per user. Xero has better inventory management features. FreshBooks excels in invoicing and time tracking. Both offer mobile apps, but FreshBooks is easier to navigate.

Wave

Wave is a free accounting software. It is perfect for startups and very small businesses. FreshBooks offers more features and better support. Wave lacks some advanced features of FreshBooks. FreshBooks includes project management and expense tracking. Wave is free, but FreshBooks provides more value for its price. Both are good options, depending on your needs.

User Reviews

When choosing accounting software for your small business, user reviews are essential. FreshBooks has received varied feedback from its users. This section will explore both the positive and negative reviews. This will help you decide if FreshBooks is the right choice for your business.

Positive Feedback

Many users praise FreshBooks for its user-friendly interface. Small business owners find it easy to navigate. This reduces the time spent on accounting tasks. The invoicing feature receives high marks. Users appreciate the customizable templates and automated reminders.

FreshBooks also gets positive reviews for its customer support. Users report that the support team is responsive and helpful. This adds value, especially for those new to accounting software. The mobile app is another highlight. It allows users to manage their finances on the go.

Negative Feedback

Not all feedback is positive. Some users find FreshBooks expensive. They believe the cost is high for small businesses with tight budgets. Others mention limited customization options. They feel the software does not offer enough flexibility.

Integration issues are another common complaint. Some users struggle to sync FreshBooks with other tools. This can be a drawback for businesses using multiple systems. Lastly, the reporting feature receives mixed reviews. Some users find it lacks depth and detail.

Credit: www.nav.com

Frequently Asked Questions

Is Freshbooks Good For Small Businesses?

Yes, FreshBooks is excellent for small businesses. It offers easy invoicing, expense tracking, and time management tools. It simplifies accounting tasks and improves efficiency.

What Are The Downsides Of Freshbooks?

FreshBooks has limited customization options. The mobile app lacks some features. It can be expensive for larger businesses.

What Is The Best Accounting Software For Small Business?

QuickBooks Online is often considered the best accounting software for small businesses. It offers features like invoicing, expense tracking, and financial reporting. Its user-friendly interface and scalability make it ideal for growing companies.

How Much Do Freshbooks Cost Per Year?

FreshBooks costs $180 per year for the Lite plan, $360 for Plus, $600 for Premium, and $3000 for Select. Prices may vary.

Conclusion

Small businesses need efficient tools. FreshBooks offers simplicity and ease of use. Its features help manage finances better. Billing becomes straightforward and less stressful. Customer support is reliable and helpful. Costs are reasonable for the features provided. FreshBooks fits well into the needs of small businesses.

It can save time and improve productivity. Overall, it’s a valuable tool for small business owners. Give it a try and see its benefits.