Square and QuickBooks are popular payment processing tools. Both offer unique features and benefits.

In today’s digital age, choosing the right payment processing tool is crucial for businesses. Square and QuickBooks are two leading options that cater to different needs. Square is known for its ease of use and quick setup. QuickBooks, on the other hand, offers robust accounting features alongside payment processing.

Deciding between the two can be challenging. Understanding their differences helps in making an informed choice. This comparison will highlight key aspects of each tool. It aims to assist businesses in selecting the best fit for their payment processing needs. Let’s dive into the details of Square and QuickBooks.

Features Comparison

Choosing the right payment processing tool is crucial for your business. Both Square and QuickBooks offer unique features that cater to different business needs. This section compares their key features to help you make an informed decision.

Transaction Fees

Transaction fees can significantly impact your bottom line. Square charges a flat rate of 2.6% + 10¢ per swipe, dip, or tap. This makes it easier to calculate costs. QuickBooks, on the other hand, charges 2.4% + 25¢ for swiped transactions. For keyed transactions, it’s 3.4% + 25¢. The different fee structures can influence your choice.

Payment Options

Variety in payment options can attract more customers. Square supports credit cards, debit cards, and mobile wallets like Apple Pay and Google Pay. It also allows you to accept payments online, in person, or through invoices. QuickBooks also supports credit and debit cards. It offers ACH bank transfers and allows payment through emailed invoices. Both tools offer flexibility, but your choice might depend on specific needs.

Understanding these features can help you choose the best payment processing tool. Consider what aligns with your business goals and customer preferences.

Credit: www.merchantmaverick.com

User Experience

Square offers user-friendly payment processing with easy setup and integration. QuickBooks excels in financial management, ideal for businesses needing detailed accounting features. Both serve different needs effectively.

Choosing the best payment processing tool involves understanding the user experience. Square and QuickBooks offer different features that affect ease of use and customer support. Let’s dive into these aspects.Ease Of Use

Square is designed with simplicity in mind. Its interface is intuitive. Even beginners can navigate without confusion. Setting up an account takes minutes. The dashboard is clean and organized. QuickBooks offers more advanced features. This can make the interface a bit complex. Users might need time to understand all functions. Setting up QuickBooks may require extra steps. The dashboard has many options, which can be overwhelming.Customer Support

Square provides robust customer support. Live chat, phone support, and email options are available. Response times are quick. The support team is knowledgeable. QuickBooks also offers customer support. However, it can be harder to reach a representative. Users often rely on online resources. The support quality is good but less accessible. Response times can vary. Understanding these aspects can help you choose the best fit. Both tools have strengths and weaknesses in user experience. Your choice should depend on your specific needs. “`Integrations

Square offers seamless integration for retail businesses, while QuickBooks provides comprehensive accounting features for various industries. Choosing the best payment processor depends on specific business needs.

Integrations are a crucial factor to consider when choosing between Square and QuickBooks for payment processing. Both offer various integrations that can streamline your business operations. But how do they stack up against each other?Software Compatibility

Square and QuickBooks both offer excellent software compatibility. Square seamlessly integrates with its own suite of tools, including POS systems and inventory management. QuickBooks, on the other hand, is renowned for its accounting software. It easily syncs with various accounting tools, making it a favorite for bookkeeping. If you already use QuickBooks for accounting, adding Square for payment processing might seem redundant. However, Square’s all-in-one solution could simplify operations for smaller businesses.Third-party Apps

Third-party app integrations can significantly enhance your business operations. Square offers a wide range of third-party apps, from e-commerce platforms to marketing tools. You can easily connect your Square account to Shopify, WooCommerce, and even Mailchimp. QuickBooks also supports numerous third-party apps, especially those focused on financial management. Apps like Expensify and Bill.com seamlessly integrate with QuickBooks. I once faced a dilemma while running my e-commerce store. I needed a robust inventory management system. Square’s seamless integration with Stitch Labs made inventory tracking a breeze, saving me hours each week. What third-party apps do you currently use? Ensuring compatibility with your payment processor can save you time and headaches. In conclusion, both Square and QuickBooks offer robust integrations. Your choice will depend on your specific needs and existing tools. Consider what integrations are crucial for your business operations. The right choice can streamline your workflow and boost your productivity.Security

Square and QuickBooks both offer strong security for payment processing. Square uses advanced encryption, while QuickBooks uses secure data storage. Both ensure safe transactions for users.

## Security When it comes to payment processing, security is a top priority. Both Square and QuickBooks offer robust security measures, but the specifics of their approaches can make a significant difference. Let’s dive into how each platform handles data encryption and fraud prevention. ###Data Encryption

Square uses advanced encryption technology to ensure your data is secure. From the moment you swipe a card, the data is encrypted and stays that way throughout the entire transaction process. This means your customers’ sensitive information is well-protected. QuickBooks, on the other hand, also employs strong encryption methods. They use 128-bit SSL encryption to protect data during transmission. This level of security is similar to what banks use, so you can be confident in its reliability. ###Fraud Prevention

Fraud prevention is another critical area where Square shines. They have a dedicated team that monitors transactions for suspicious activity. If something looks off, they act swiftly to prevent fraud. I’ve personally experienced their quick response when a fraudulent transaction was attempted on my account. QuickBooks also takes fraud prevention seriously. They offer tools like automatic fraud detection and real-time alerts. These features help you stay one step ahead of potential threats. Imagine getting an alert the moment something unusual happens—that’s peace of mind. Both platforms offer solid security features, but your choice may depend on which specific measures resonate more with your business needs. What security features matter most to you?Pricing

Square offers straightforward pricing with no monthly fees, making it ideal for small businesses. QuickBooks provides tiered pricing and additional features, suitable for larger companies.

When deciding between Square and QuickBooks for payment processing, pricing is a critical factor to consider. Both platforms offer a range of features, but how much will they cost you? Let’s break down the pricing for each and see how they compare in terms of value for your money.Subscription Plans

Square offers a straightforward pricing structure. There are no monthly fees for the basic plan, which includes essential features like payment processing, invoicing, and a free point-of-sale (POS) system. If you need more advanced features, like payroll or marketing tools, you can opt for premium plans starting at $29 per month. QuickBooks, on the other hand, requires a subscription. The pricing starts at $25 per month for the Simple Start plan, which includes invoicing and expense tracking. For more comprehensive features like payroll and inventory management, you can upgrade to higher-tier plans, with pricing that can go up to $150 per month. Which plan fits your budget? If you’re just starting out, Square’s free plan might be appealing. But if you need more robust accounting features, QuickBooks could be worth the investment.Hidden Costs

Are there any hidden costs with Square or QuickBooks? It’s crucial to be aware of potential extra charges that might catch you off guard. Square is known for its transparency. You pay a flat fee of 2.6% + 10¢ per transaction for in-person payments, and 2.9% + 30¢ for online payments. There are no hidden fees, making it easy to predict your monthly costs. QuickBooks can be a bit trickier. While the subscription fees are clear, additional costs can add up. For instance, if you choose QuickBooks Payroll, you’ll need to pay an extra monthly fee starting at $45. Also, QuickBooks charges 2.4% + 25¢ per transaction for in-person payments and 2.9% + 25¢ for online transactions. These hidden costs can quickly increase your expenses. Have you factored these into your budget? When comparing Square and QuickBooks, consider not just the subscription fees, but also the transaction fees and any additional costs. This will give you a clearer picture of which platform offers the best value for your payment processing needs.

Credit: cloudfriday.com

Pros And Cons

Square offers seamless integration with point-of-sale systems and is user-friendly. QuickBooks excels in comprehensive accounting features. Consider your business needs.

When it comes to choosing between Square and QuickBooks for payment processing, understanding the pros and cons can help you make an informed decision. Both platforms offer unique benefits and some limitations that can impact your business operations. Let’s break down the advantages and disadvantages of each to see which one fits your needs best.Advantages Of Square

Square is known for its user-friendly interface and straightforward setup. You can start accepting payments quickly with minimal hassle. Their hardware is versatile and affordable. The Square Reader, for example, is a compact device that you can attach to your smartphone. This makes it perfect for businesses on the go. Square offers flat-rate pricing. This means you pay a consistent fee per transaction, without worrying about hidden costs. This transparency can help you manage your budget more effectively.Advantages Of Quickbooks

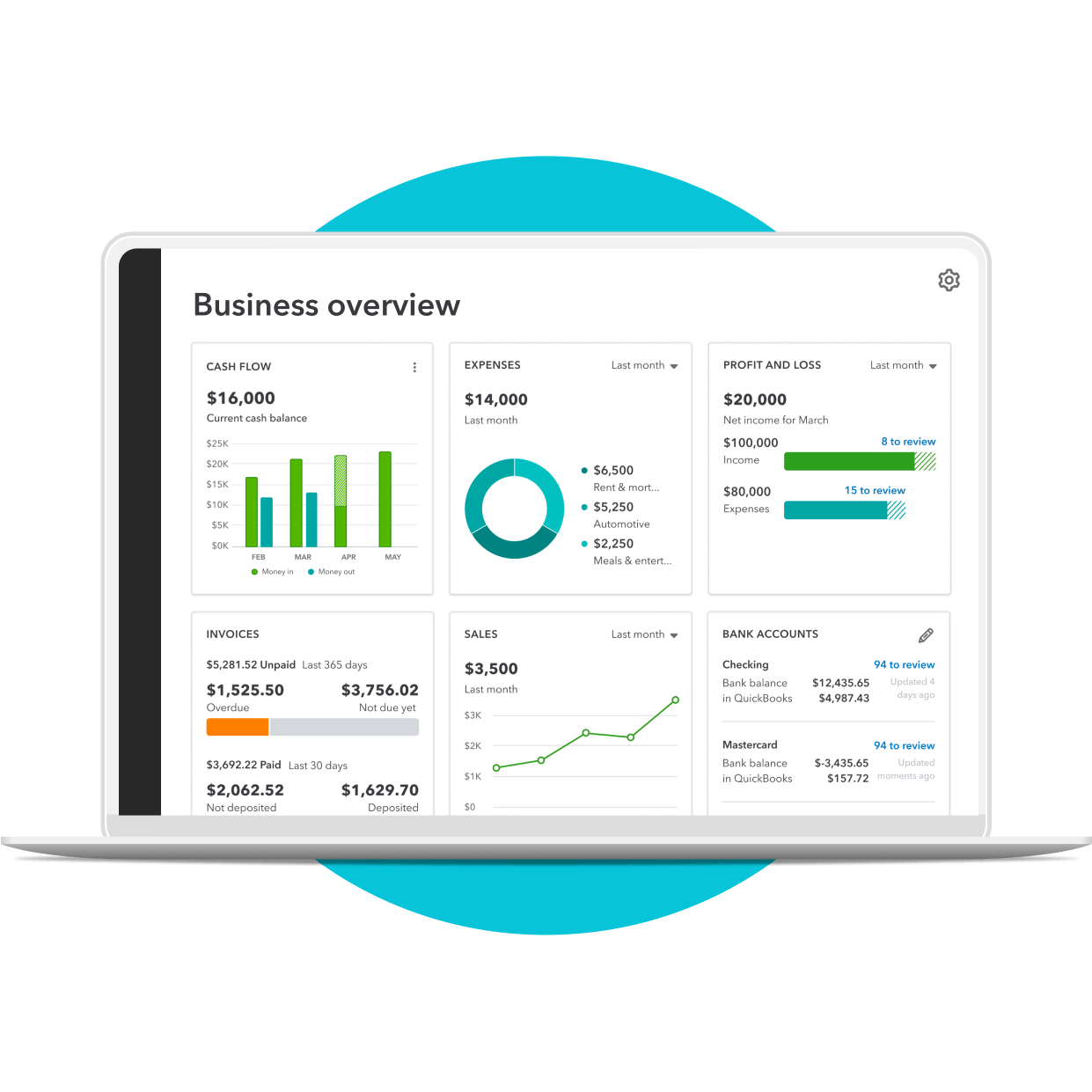

QuickBooks integrates seamlessly with its accounting software. If you already use QuickBooks for your accounting, adding their payment processing is a no-brainer. It streamlines your financial management. QuickBooks offers robust reporting features. You can generate detailed financial reports that help you understand your cash flow and make data-driven decisions. Their customer support is top-notch. QuickBooks provides various support channels, including phone, chat, and email, ensuring you get help when you need it. In my experience, Square’s ease of use made it the go-to choice for my small pop-up shop. The simplicity of the setup and the flat-rate pricing helped me keep costs predictable. On the other hand, QuickBooks was invaluable when I started a more complex business that required detailed financial tracking. The integration with their accounting software saved me a lot of time and reduced errors in my financial records. What is more important to you: simplicity and ease of use, or robust reporting and integration? Your answer will guide you towards the right choice for your business. Deciding between Square and QuickBooks involves considering these pros and cons based on your specific business needs. Which features resonate more with your current situation?Best Use Cases

When deciding between Square and QuickBooks for payment processing, it’s essential to consider the best use cases for each. Both platforms offer unique advantages tailored to different business sizes and needs. Let’s dive into how each can serve small businesses and large enterprises effectively.

Small Businesses

Square is often the go-to choice for small businesses. Its user-friendly interface and straightforward pricing make it easy to get started with minimal hassle.

Imagine you run a local coffee shop. You need a simple, reliable system to process payments quickly. Square’s point-of-sale (POS) system can be set up in minutes, allowing you to handle transactions smoothly.

Square also offers additional tools like inventory management and customer feedback, which are perfect for small operations. These features enable you to keep track of stock and understand your customers better, all from one platform.

Additionally, Square provides a mobile payment option, which can be a game-changer if you’re selling products at markets or pop-up events. You can take payments on the go, making your business more flexible and accessible.

Large Enterprises

QuickBooks shines when it comes to larger enterprises that need more comprehensive accounting and financial management. If your business requires detailed financial reporting and integration with other systems, QuickBooks can handle these tasks efficiently.

Consider a mid-sized manufacturing company with complex financial needs. QuickBooks offers advanced features like payroll management, extensive reporting, and multi-user access. These tools are crucial for keeping your financial operations in check.

One of the standout features of QuickBooks is its seamless integration with other Intuit products and third-party applications. This means you can connect your payment processing with your accounting software, creating a streamlined workflow that saves time and reduces errors.

Another advantage is QuickBooks’ scalability. As your business grows, you can easily upgrade your plan to access more features and accommodate more users. This flexibility ensures that QuickBooks can grow with your enterprise.

When choosing between Square and QuickBooks, consider your business size and specific needs. Are you a small business looking for simplicity and mobility? Or a large enterprise needing robust financial management? Your answer will guide you to the best choice for your payment processing needs.

Credit: quickbooks.intuit.com

Frequently Asked Questions

Can Quickbooks Be Used As A Payment Processor?

Yes, QuickBooks can be used as a payment processor. It integrates with QuickBooks Payments for seamless transactions.

What Percentage Does Quickbooks Take From Payment Processing?

QuickBooks charges 2. 4% to 3. 4% plus 25 cents per transaction for payment processing, depending on the payment method used.

Is Quickbooks Being Phased Out?

No, QuickBooks is not being phased out. It remains a popular accounting software with continuous updates and support.

Does Square Payments Integrate With Quickbooks?

Yes, Square payments integrate with QuickBooks seamlessly. This integration allows you to sync transactions automatically. Managing finances becomes easier and more efficient.

Conclusion

Choosing between Square and QuickBooks can be tough. Both offer great payment processing options. Square is user-friendly and ideal for small businesses. QuickBooks integrates well with accounting needs. Decide based on your business size and needs. Evaluate the features each offers.

Consider your budget and growth plans. With the right choice, payment processing will be smooth. Both platforms support efficient financial management. Select the one that aligns with your business goals. A good payment system helps improve customer satisfaction. Make an informed decision and streamline your transactions.