Small businesses need efficient accounting software. Xero is often recommended for this role.

Why is Xero considered the best small business accounting software? This review explores its features, benefits, and usability. With Xero, managing finances becomes easier and more organized. It helps track expenses, send invoices, and manage payroll without hassle. This software is designed to cater to the unique needs of small businesses, providing an intuitive interface and robust functionality.

In the following sections, we will delve into what makes Xero stand out among its competitors. By understanding its key features, you can decide if Xero is the right tool for your business. Let’s uncover why many small business owners trust Xero for their accounting needs.

Credit: www.youtube.com

Features

When choosing accounting software for your small business, the features offered can make a significant difference in your daily operations. Xero stands out with its user-friendly interface and powerful tools designed to simplify accounting tasks. Let’s dive into some of the standout features that make Xero a top choice for small businesses.

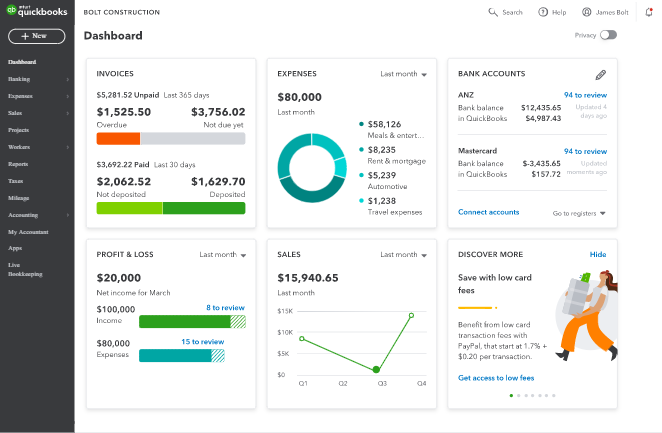

Dashboard

The Xero dashboard offers a comprehensive overview of your business’s financial health. You’ll see key metrics like cash flow, invoices, and bank balances right when you log in. This immediate access to vital information helps you make informed decisions quickly.

Personally, I’ve found the dashboard to be incredibly intuitive. It’s like having a snapshot of your business’s financial status at your fingertips. You won’t waste time digging through reports to find what you need.

Invoicing

Creating and sending invoices with Xero is a breeze. You can customize invoices to match your brand, set up automatic reminders for overdue payments, and even accept online payments directly through the invoice. This streamlines the payment process and improves cash flow.

Imagine never having to chase clients for payments again. Automated reminders save you time and reduce stress, allowing you to focus on growing your business.

Bank Reconciliation

Bank reconciliation is one of the most tedious accounting tasks, but Xero simplifies it. The software automatically matches your bank transactions with your recorded transactions, saving you hours of manual work. You can also set up bank rules to automate the categorization of transactions.

This feature is a game-changer. Instead of spending hours poring over bank statements, you can reconcile your accounts in minutes. It’s like having a personal assistant for your finances.

Are you ready to streamline your small business accounting with Xero? Imagine spending less time on tedious tasks and more time growing your business. What feature do you think will benefit you the most?

Pricing Plans

Choosing the right accounting software is crucial for small businesses. Xero offers a range of pricing plans to suit different needs. Below, we’ll explore the details of each plan. This will help you make an informed decision.

Starter Plan

The Starter Plan is ideal for small businesses. It costs $12 per month. This plan includes basic features. You can send 20 invoices and quotes. You can enter five bills. Reconciliation of bank transactions is up to 20 per month.

Standard Plan

The Standard Plan costs $34 per month. It offers more flexibility. You can send unlimited invoices and quotes. Entering bills is also unlimited. Reconcile as many bank transactions as needed.

Premium Plan

The Premium Plan is the most comprehensive. It costs $65 per month. This plan includes all features of the Standard Plan. It also supports multiple currencies. This is useful for businesses dealing with international clients.

User Experience

The user experience in accounting software is crucial. Xero aims to offer a seamless experience. This review will focus on two key aspects: Ease of Use and Customer Support.

Ease Of Use

Xero is known for its intuitive interface. Users find the dashboard easy to navigate. The layout is clean and simple. It helps users find what they need quickly. Tasks such as invoicing and tracking expenses are straightforward. The software provides clear instructions. Even beginners can use it without much training. There are helpful tooltips and guides throughout the platform. This makes the learning curve gentle.

Customer Support

Good customer support is vital for any software. Xero offers reliable support options. Users can access 24/7 email support. The response time is quick. There are also extensive online resources. These include tutorials and a community forum. Phone support is not available, which might be a drawback for some. However, the comprehensive help center often suffices. Users generally find the support team helpful and knowledgeable.

Credit: ezytaxaccounting.com.au

Integrations

Xero offers seamless integrations that simplify small business accounting tasks. Connects effortlessly with over 800 third-party apps. Ideal for streamlining financial processes.

Integrations are a vital aspect when choosing accounting software for your small business. Xero shines in this area, offering robust connectivity with various platforms. This not only streamlines your workflow but also saves you valuable time. Let’s dive into two key integration categories that make Xero a top choice.Payment Gateways

Xero integrates seamlessly with numerous payment gateways, making it easier for you to get paid on time. You can connect with popular options like PayPal, Stripe, and Square. This allows your clients to pay invoices directly from their email, speeding up the payment process. Imagine how much time you’ll save by not having to manually update each transaction. Plus, you can automatically reconcile payments, reducing the risk of human error. It’s a win-win for both you and your clients.Third-party Apps

Xero also supports a wide range of third-party apps, enhancing its functionality. Whether you need CRM software, inventory management, or project tracking, there’s likely an app for that. Apps like HubSpot, Shopify, and Trello can be easily integrated with Xero. This flexibility means you can customize Xero to fit your unique business needs. Using these integrations, you can centralize your operations and gain real-time insights into your business performance. What third-party app would make your life easier if it could talk to your accounting software? With Xero, you have the flexibility to build an ecosystem that supports your business growth.Pros And Cons

Choosing the right accounting software for your small business is essential. Xero has gained popularity for its user-friendly interface and powerful features. But like any software, it has its strengths and weaknesses. Understanding the pros and cons can help you make an informed decision.

Advantages

Xero provides a clean and intuitive interface. Even beginners can navigate easily.

It offers strong integration with other business tools. This includes PayPal, Stripe, and many more.

It supports multiple currencies. This is a big plus for businesses dealing internationally.

Real-time updates keep your financial data current. You can make quick decisions based on the latest information.

Customer support is responsive. Many users report quick and helpful responses.

Disadvantages

Xero might be overwhelming for very small businesses. The many features can seem complex.

It lacks phone support. Some users prefer talking to a real person.

Advanced reporting features require higher-tier plans. This might increase costs for small businesses.

Bank reconciliation can sometimes be slow. This could affect your workflow.

Offline access is limited. You need an internet connection to use most features.

Comparison With Competitors

Xero stands out among small business accounting software for its user-friendly interface and comprehensive features. Compared to competitors, Xero offers seamless integration and real-time updates.

When evaluating the best accounting software for your small business, it’s essential to compare Xero with its main competitors. This comparison helps you understand the unique features, benefits, and potential drawbacks of each option. Let’s dive into how Xero stacks up against QuickBooks and FreshBooks.Quickbooks

QuickBooks is a well-known name in the world of accounting software. Many small businesses rely on it for its robust features and user-friendly interface. However, Xero offers a few advantages. Xero’s pricing structure is more transparent with no hidden fees. Additionally, Xero allows unlimited users on all plans, which is a significant benefit for growing businesses. QuickBooks, on the other hand, charges extra for additional users. This can add up quickly if your team expands. Furthermore, Xero’s integration with third-party apps is extensive, providing flexibility and seamless workflow.Freshbooks

FreshBooks is another popular choice for small businesses, particularly those in service-based industries. It’s known for its excellent invoicing and time-tracking features. While FreshBooks excels in simplicity, Xero provides more comprehensive accounting capabilities. For instance, Xero offers double-entry bookkeeping, which is crucial for accurate financial management. FreshBooks is easier to use for beginners, but Xero’s learning curve is worth it for the additional functionality. Xero also supports a wider range of currencies, making it a better option if you deal with international clients. Which software suits your business best? Consider your specific needs. If you value extensive features and scalability, Xero might be the better choice. If simplicity and ease of use are your top priorities, FreshBooks could be more suitable.

Credit: www.fahimai.com

Frequently Asked Questions

What Are The Disadvantages Of Xero Accounting Software?

Xero accounting software can be costly for small businesses. Limited customer support and occasional system downtime are also concerns. The learning curve might be steep for beginners.

Is There Anything Better Than Xero?

Yes, alternatives to Xero exist, like QuickBooks and FreshBooks. The best option depends on your specific business needs.

What Is The Best Accounting Software For Small Business?

QuickBooks is the best accounting software for small businesses. It offers user-friendly features, robust functionality, and excellent customer support.

Which Software Is Better, Quickbooks Or Xero?

QuickBooks offers robust features for small businesses, while Xero is ideal for streamlined accounting with user-friendly design. Choose based on specific needs.

Conclusion

Xero stands out as a solid choice for small business accounting. It offers user-friendly tools to manage finances easily. With its cloud-based system, you can access it anytime, anywhere. Integration with other apps makes operations smoother. Reasonable pricing plans cater to various business needs.

Excellent customer support adds to its appeal. Overall, Xero simplifies accounting, helping businesses focus on growth. Give Xero a try and see how it fits your needs.